ENVISIONING A FRESH NEW START FOR UBANK CUSTOMERS

Design Lead ∙ Fjord ∙ 2019–20

Research ∙ Service Design ∙ Product Strategy ∙ Design Leadership & Coaching

UBank emerged as Australia’s first digital bank some years ago, with a strong ethos and a good brand perception in the home loans space. However, in the world of everyday banking, UBank was having challenges engaging with and retaining new customers.

The client asked us to look into their existing customer experience in the the first 90 days – and then create a future state and prototyped experience concepts to inform their roadmap for the next 12-24 months.

DISCOVERY & ANALYSIS

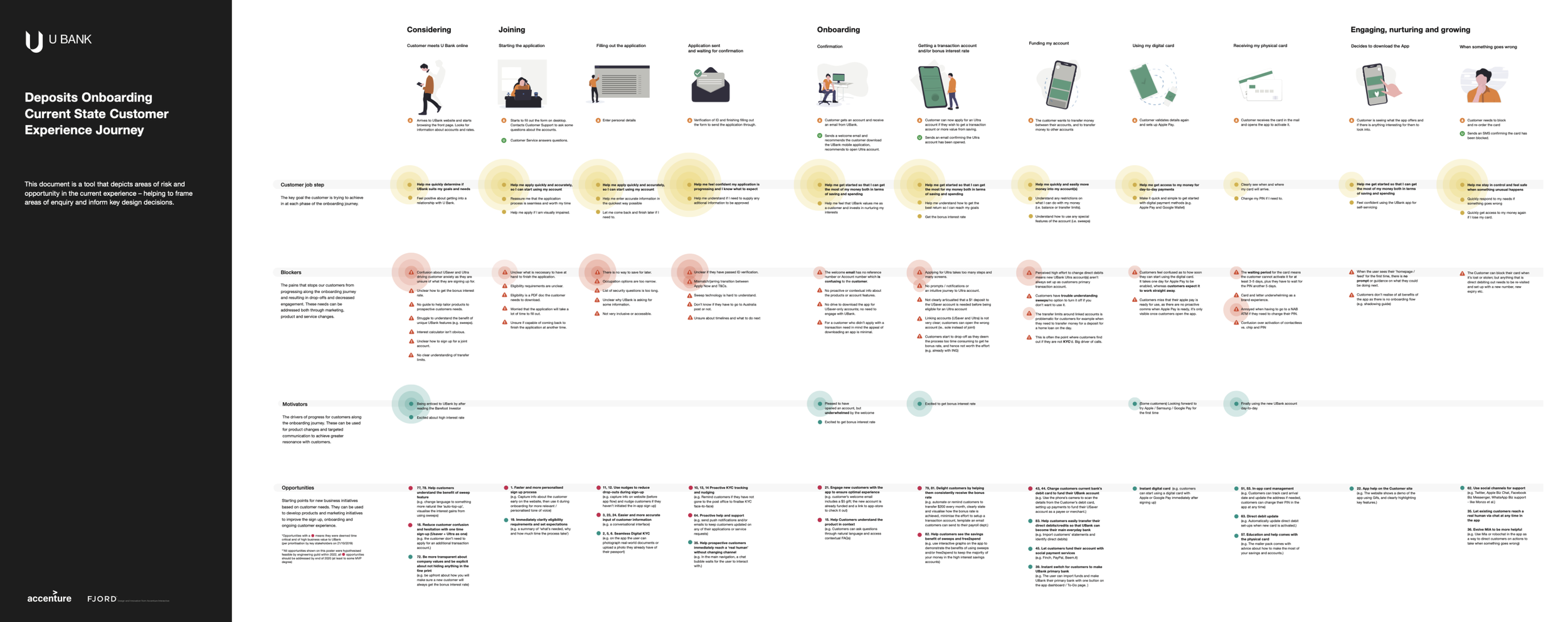

During the discovery phase, we conducted stakeholder interviews to gather insights and frame our scope.

We also conducted secondary research and benchmarking to understand industry standards and best practices - what does parity look like, and how might we exceed expectations?

To gain a comprehensive understanding of the current state, we conducted qualitative switch interviews with customers who had recently changed banks or utility services.

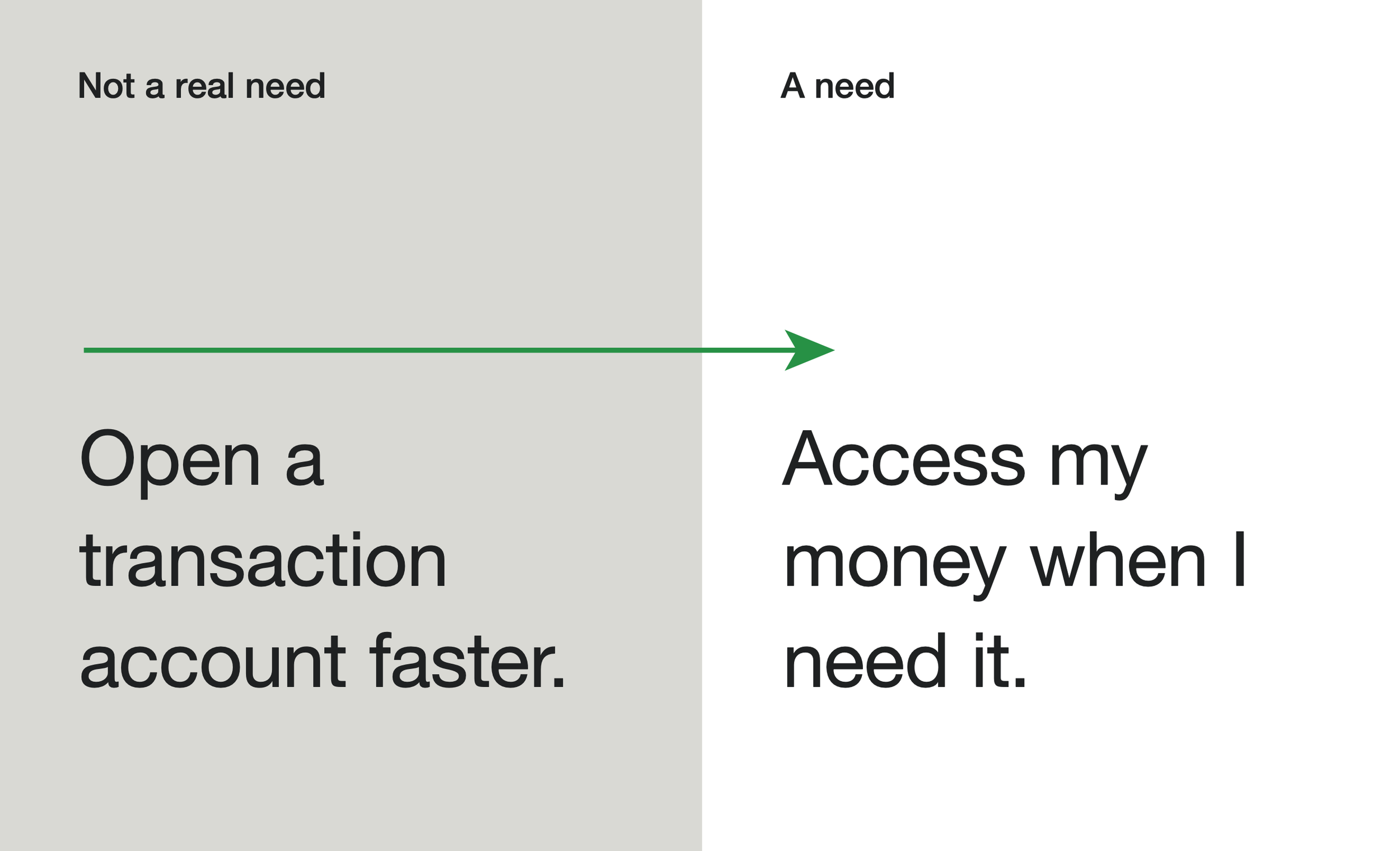

We visualised Jobs to Be Done (JTBD), user needs and pain points across the journey, and then ran a quantitative JTBD prioritisation survey to prioritise these needs for importance and impact on experience.

EXPERIENCE DEFINITION & STRATEGY

Money Mindsets, and a makeshop

Understanding the attitudes and behaviours of our users towards money was essential for crafting an onboarding strategy that would resonate.

Partnering with our London peers who had recently completed a deep study on this topic, we could work with a set of spending behaviours, as well as ‘enemies’ of good money management, to shape our creative process.

We explored these along with our customer needs, in a co-creation workshop with our design teams, and UBank’s product, technology and leadership teams, to identify how we might begin to play.

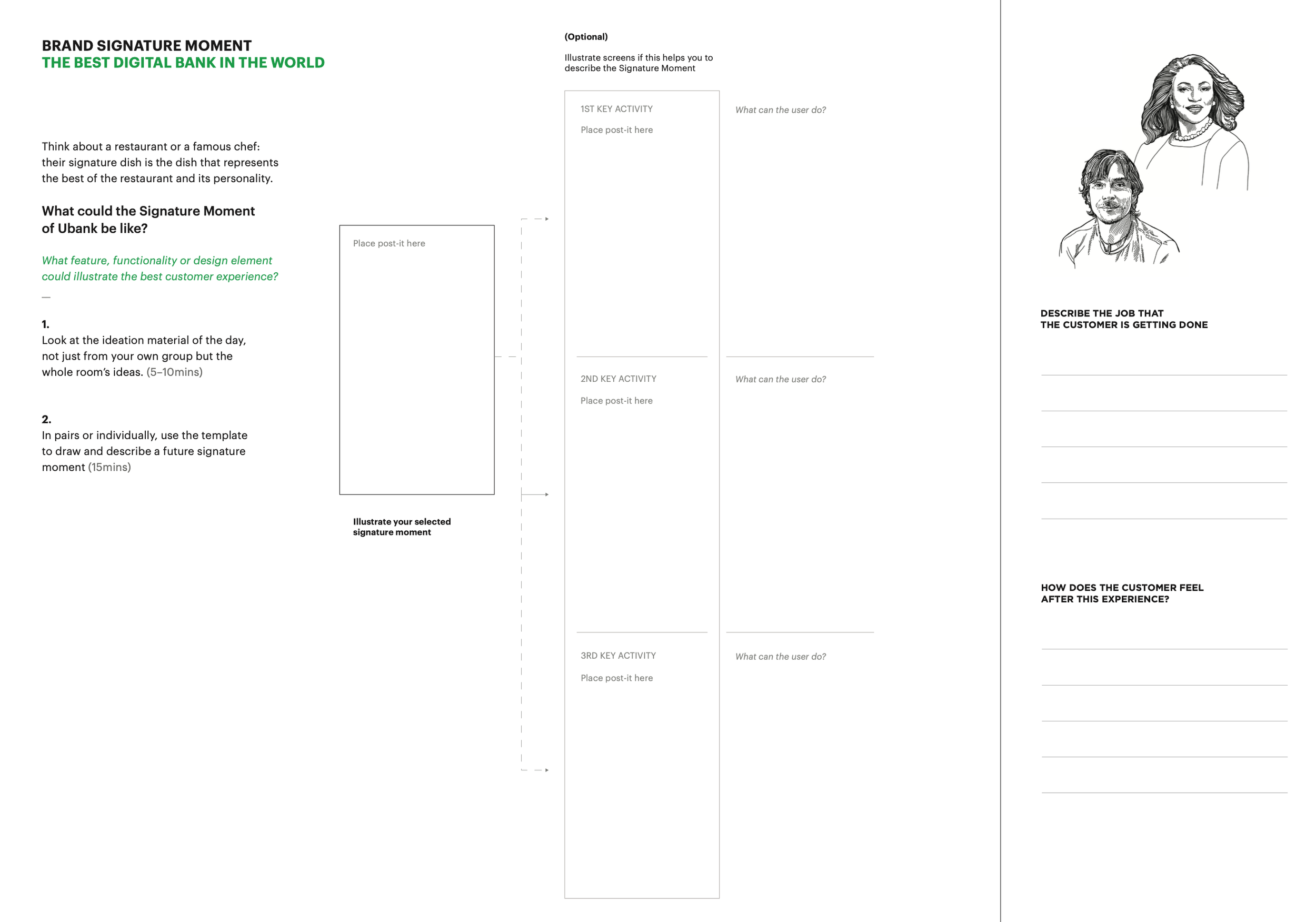

Working with key moments in the user journey, or 'signature moments', was essential for focusing our efforts on the most impactful areas for improvement, in a way that would be the best expression of the UBank brand.

creating value beyond onboarding

Beyond the scope of a fresher sign-up flow, it was important to craft an experience for new customers that made them instantly see the value in this new bank.

We already had a roadmap of ‘parity’ features from our market benchmarking, but wanted to sharpen our distinct proposition and build on these signature moments.

Developing low-fidelity service concepts and subjecting them to qualitative testing allowed us to iteratively refine our ideas based on user feedback.

delivery of our vision, prototype and roadmap for 24 months

We developed an engagement model and features roadmap to guide the product teams for the next 1-2 years, ensuring a clear direction and actionable plan for achieving the vision.

A conversational sign-up flow, combined with smoother customer identification steps, reduced the time to get on board and start seeing the value.

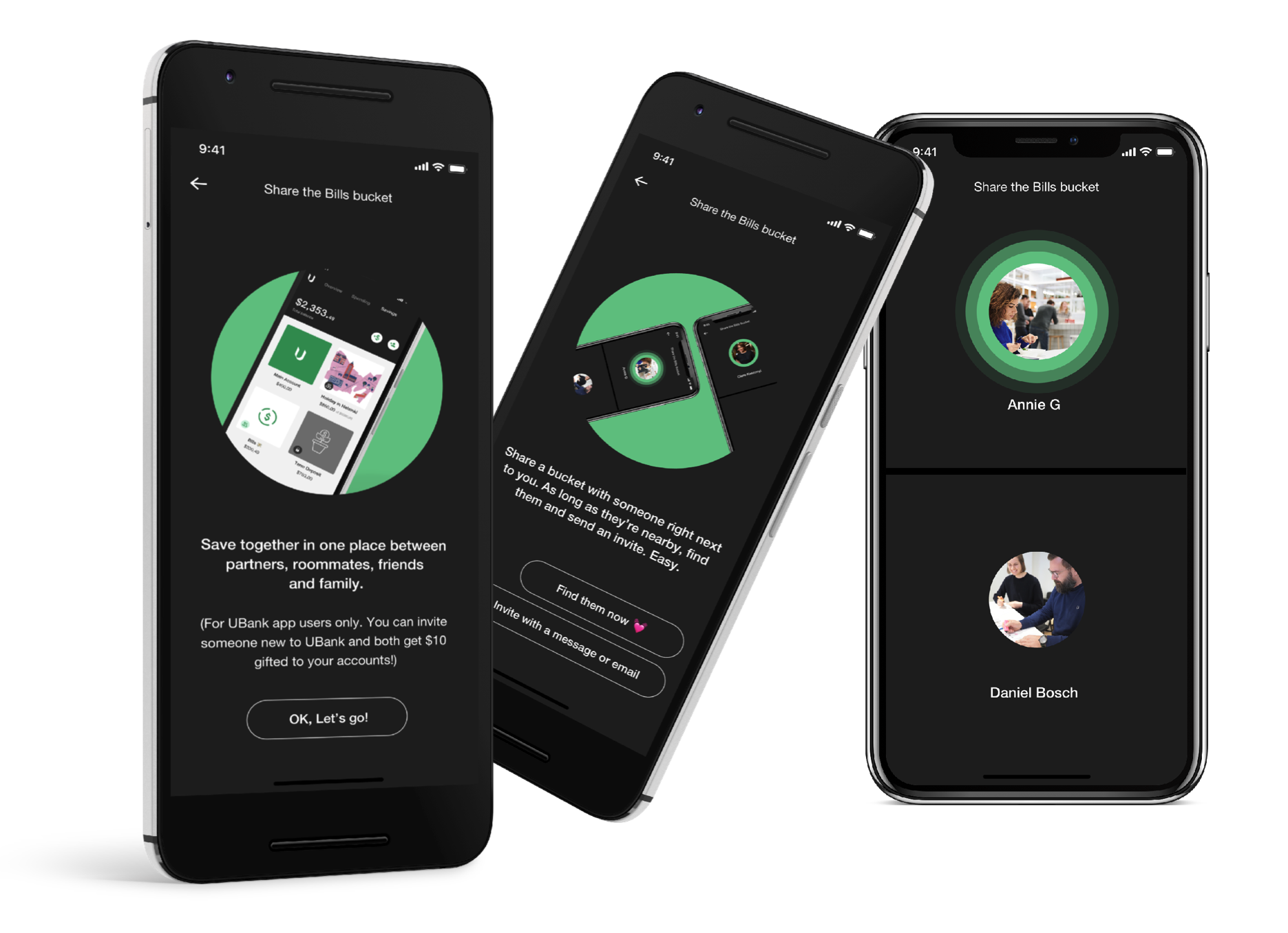

A series of new money management features aimed at differentiating UBank’s offerings in the market, would help new customers see tangible benefits in their new bank.

outcome

The product teams and leadership were aligned on where they need to get to in a year’s time and what that looks like, and had a tangible, co-created roadmap to get there.

The collaboration we had with the teams also impacted their approach to digital product creation, and they asked us to continue on to setting up a Design System capability for them.